ebike tax credit status

A Allowance of creditIn the case of an individual there shall be allowed as a credit against the tax imposed by this subtitle for any taxable year an amount equal to 30. Electric Bicycle Incentive Kickstart for the Environment Act or the E-BIKE Act.

Electric Bicycle Incentives Go Local But Feds Can Do More Streetsblog Usa

The proposed tax incentive detailed in the E-BIKE Act would give taxpayers who purchase an e-bike up to 30 back of the retail price in the form.

. You were domiciled and maintained a primary residence as a homeowner or tenant in New Jersey. Electric Bike Tax Deduction Info. Here are the steps for Status of Legislation.

Business profile of Tax Credits LLC located at 45 Knightsbridge Road 22 Piscataway NJ 08854. Get reviews hours directions coupons and more for Tax Credits at 242 Old New Brunswick Rd Piscataway NJ 08854. The Electric Bicycle Incentive Kickstart for the Environment Act establishes a consumer tax credit of up to about thirty percent of the cost of an eBike purchase.

1019 is a bill in the United States Congress. This credit would be available to all e-bike. The e-bike tax credit would phase out at 75000 adjusted gross income for individual taxpayers 112500 for heads of household and 150000 for married filing jointly.

The tax credit for ebike can be claimed when you have bought an eligible bike. The E-Bike Act would create a federal tax credit equal to 30 of the purchase price of electric bikes up to a maximum credit of 1500. The credit ranges between 2500 and 7500 depending on the capacity of the battery.

Here is an article from Elektrek about tax credits for electric cars so the infrastructure is already in place with the state and federal forms click here As stated you might get up to a 1500. Service by the taxpayer for use within the United States. This is not a motorcycle this is an e-bike.

Beginning in 2022 taxpayers may claim a credit of up to 1500 for electric bicycles placed into. The credit begins to phase out for a manufacturer when that manufacturer sells. As part of Bidens Build Back Better bill individuals who make 75000 or less qualify for the maximum credit of up to 900.

To access your free listing please call 1833467-7270 to verify youre the business owner or authorized representative. Browse reviews directions phone numbers and more info on Tax Credits LLC. You can claim the tax credit for your e-bike purchase any time during the tax year.

A bill must be passed by both the House and Senate in identical form and then be signed by the President to become law. You are eligible for a property tax deduction or a property tax credit only if. Search for other No Internet Heading Assigned in Piscataway on The.

E Bike Tax Credit Worth Fighting For Momentum Mag

Denver Spent 4 1 Million To Get More People On E Bikes It Worked

Let S Pass The E Bike Act Rei Co Op

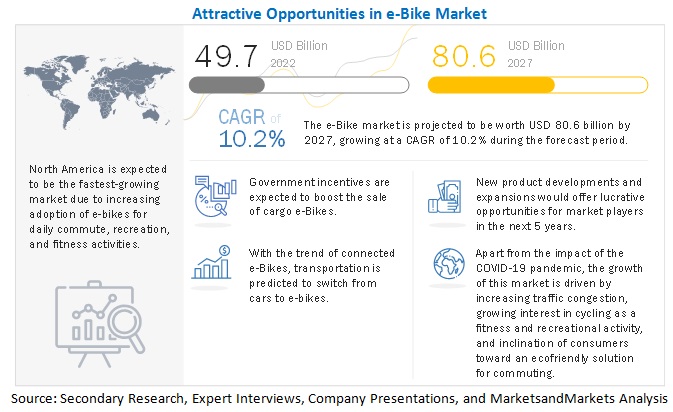

E Bike Market Share Size Trends 2022 2027

California Rebates With Electric Bicycle Incentive Project

Colorado Sets Details For E Bike Rebate Program

A 900 Tax Credit For E Bikes Is Part Of Infrastructure Bill Los Angeles Times

Proposed Us E Bike Tax Credit Could Kickstart Biden S Clean Energy Revolution Cycling Weekly

E Bike Buyers Tax Credit On Tap From Lawmakers Aimed At Slowing Climate Change

Understanding The Electric Bike Tax Credit

E Bike Act Could Slash Cost Of E Bikes By 1 500

Denver Launches Nation S Best E Bike Rebate Program

California Congressman Wants To Introduce A Tax Credit For E Bike Purchases Cnet

900 E Bike Tax Credit Possible In Build Back Better Bloomberg

The Ultratrx King E Cheetah Full Suspension Super Bike 72v 15 000w Max Speed 87 Mph 70 80 Miles In Distance Fat Tire Electric E Bikes Ultratrx Electric Bicycles

26 True 1000w Electric E Bike Fat Tire Carbon Fiber Bicycle Li Battery Samsung Ebay

Folding Electric Bike Solves Pilot Ground Transport Issues Aopa

Here S Why The E Bike Companies Say A 30 Us Tax Credit Could Happen

/cdn.vox-cdn.com/uploads/chorus_asset/file/22181315/VRG_ILLO_4348_BikeBoom.jpg)

The E Bike Tax Credit Is Only Mostly Dead As Supporters Plot Next Steps